Taiwan's Ministry of Environment releases 3 drafts of the carbon fee regulations

Share to Line Share to Facebook Share to X Print ContentTo establish a carbon pricing system in Taiwan and steadily promote carbon reduction, the Ministry of Environment (MOENV) has announced the drafts of "Regulations Governing the Collection of Carbon Fees," "Designated Greenhouse Gas Reduction Goal for Entities Subject to Carbon Fees," and "Regulations for Administration of Self-Determined Reduction Plan." The three draft regulations announced on April 29 make up the supporting mechanism for future implementation of the carbon fee system, aimed at accelerating and scaling up the reduction efforts of entities subject to carbon fees.

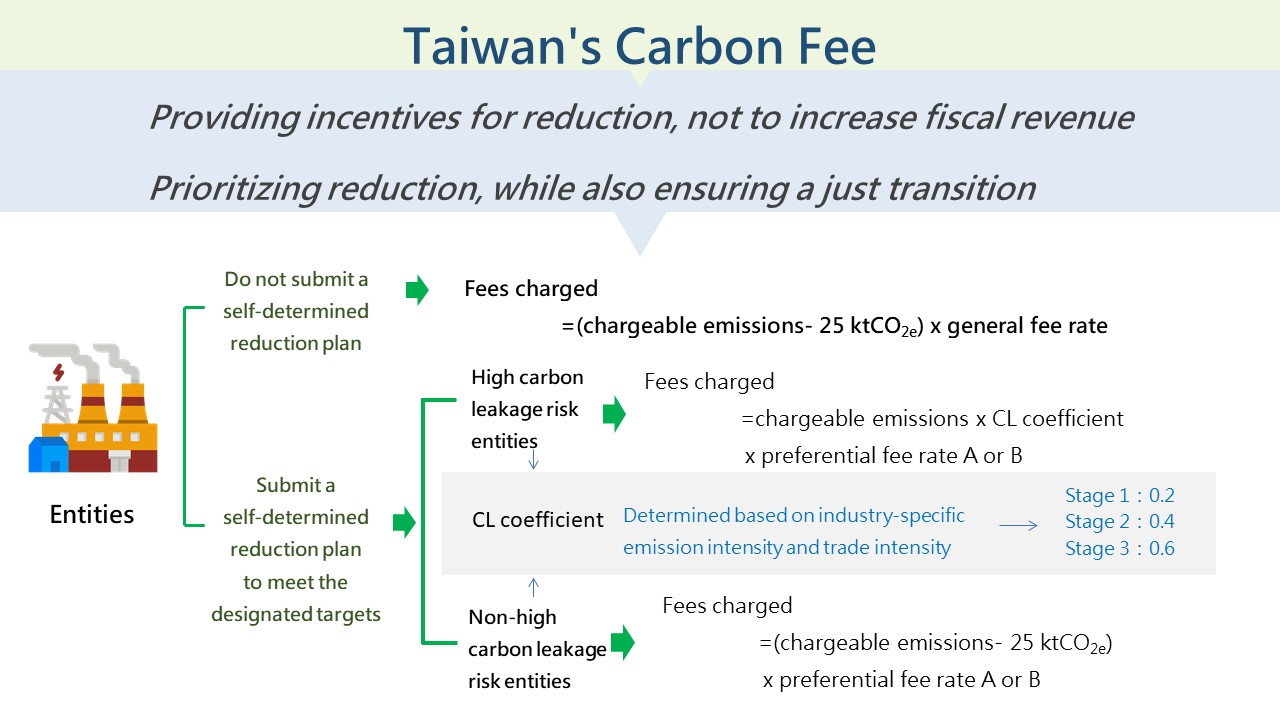

The MOENV emphasizes that the primary goal of the carbon fee system is to incentivize reductions rather than generate fiscal revenue. The draft regulations will serve as important guidelines for the feepayers, helping them to plan their carbon reduction measures and pathways towards Taiwan's 2050 net-zero target. There is a 60-day public consultation period for these regulations, during which the MOENV will engage in social dialogue to build consensus among all stakeholders.

Key points of the three draft regulations:

The draft of "Regulations Governing the Collection of Carbon Fees"

- Entities subject to carbon fees: Initially, the fee will be levied on power and manufacturing industries that emit more than 25,000 metric tons of carbon dioxide equivalent per year. To ensure fair competition within the same industry, entities may deduct a threshold of 25,000 metric tons from their chargeable emissions when calculating the fees.

- Payment timing: Feepayers must calculate and pay the carbon fee by the end of May each year, based on the greenhouse gas emissions from the previous year (January 1 to December 31).

- Carbon fee calculation: The payable carbon fee is determined by multiplying 'chargeable emissions' by the 'fee rate.' To address concerns about international competitiveness and the need for a transition period to low-carbon operations, a carbon leakage risk adjustment mechanism has been designed. This mechanism provides different risk coefficients (0.2, 0.4, 0.6) for industries with high carbon leakage risk. Entities at high carbon leakage risk must submit and have a self-determined reduction plan approved by the central competent authority to qualify for this mechanism. In addition, the charged emissions of such industries must not be deducted from 25,000 metric tons of carbon dioxide equivalent.

The drafts of "Designated Greenhouse Gas Reduction Goal for Entities Subject to Carbon Fees" and "Regulations for Administration of Self-Determined Reduction Plan":

According to Article 29 of the Climate Change Act, entities that submit self-determined reduction plan—including strategies such as switching to low-carbon fuels, adopting negative emission technologies, improving energy efficiency, utilizing renewable energy, or enhancing industrial processes—may apply for approval of preferential rates. The MOENV’s drafts are aimed at achieving the nation's 2030 reduction target.

- Designated GHG Reduction Targets: Two methods are provided for determining the designated reduction targets: one is based on the industry-specific reduction rates derived from the Science-Based Targets initiative (SBTi), and the other uses benchmarks from both domestic and international best available technology alongside Taiwan's 2030 Nationally Determined Contributions (NDC).

- Self-Determined Reduction Plan: Entities wishing to qualify for the preferential fee rate must select one of the target calculation methods, set their designated reduction targets for 2030, and submit a self-determined reduction plan for review by a team formed by the central competent authority.

- Performance review: The central competent authority will annually review the implementation progress of the self-determined reduction plan. The entities must submit a report on the previous year's implementation progress of their self-determined reduction plan implementation before the end of April each year. If the entities meet the progress targets, they may apply the preferential fee rate for that year.

To encourage the carbon fee payers to drive reductions among non-payers, the ministry has set a ratio of 1.2 for using the emission reduction credits from voluntary reduction projects and offset projects to deduct chargeable emissions, with a cap of 10% of the feepayer's total chargeable emissions. Additionally, for industries that are not at high risk of carbon leakage, the ratio for using the credits from pre-implementation project reductions in the early two years of the carbon fee implementation is set at 0.3. These non-high-risk industries are also permitted to use internationally recognized reduction credits, up to 5% of their chargeable emissions.

The ministry emphasizes that the carbon fee system is designed primarily to incentivize reductions rather than generate revenue. The aim is to accelerate Taiwan's industrial decarbonization and low-carbon transformation through the economic incentives provided by the carbon fee mechanism.

Taiwan's Carbon Fee

- Source:

- Ministry of Environment

- Published:

- 2024-05-09

- Updated:

- 2024-08-16